In the wake of the financial crisis, after hundreds of new regulations and capital requirements were thrust upon the U.S. banks, there's no way that we'll see bank stocks take another nosedive in the near future, right?

Wrong. There may not be an American-centric banking crash anytime soon, but that doesn't mean investors in international banks are immune to pain. After the U.S. financial sector outperformed the S&P 500 in 2012 and shares of a few banks such as Bank of America more than doubled in value, many investors are beginning to worry that the rally for U.S. banks is nearing its end. First-quarter results highlighted tepid loan demand and discouraging revenue numbers.

Trouble overseas

However, with popular valuation-metrics, like price-to-tangible book value, still pointing to the undervalued nature of the sector, I believe U.S. banks seem to have more upside than downside in the long term. But if we look at some international bank stocks, the story looks surprisingly different.

5 Best Long Term Stocks To Watch For 2014: River Valley Bancorp.(RIVR)

River Valley Bancorp operates as the holding company for River Valley Financial Bank that provides various banking products and services to consumer and commercial customers. The company accepts various deposit products that include fixed rate certificates of deposit, NOW, MMDAs and other transaction accounts, individual retirement accounts, and savings accounts. Its loan portfolio comprises residential loans that include one- to four-family residential loans; construction loans; nonresidential real estate loans; multi-family loans; land loans; commercial loans; and consumer loans, such as auto loans, home improvement loans, unsecured installment loans, loans secured by deposits, and mobile home loans. It operates 9 full-service office locations located in Jefferson, Floyd, and Clark counties, Indiana, and Carroll County, Kentucky; and 14 automated teller machines. The company was founded in 1875 and is based in Madison, Indiana.

5 Best Long Term Stocks To Watch For 2014: DLF Ltd (DLF.NS)

DLF Limited is engaged in the business of colonization and real estate development. The Company�� primary business is development of residential, commercial and retail properties. The operations of the Company span all aspects of real estate development, from the identification and acquisition of land, to planning, execution, construction and marketing of projects. The Company is also engaged in the business of generation of power, provision of maintenance services, hospitality and recreational activities and life insurance. The development business of the Company includes Homes and Commercial Complexes. The Homes business caters to three segments of the residential market: Super Luxury, Luxury and Premium. In December 2013, the Company announced that it has completed the sale of its 74% stake in the insurance joint venture with Prudential Financial, Inc. to Dewan Housing Finance Corporation Limited (DHFL) and its group entities.

Vanguard Natural Resources, LLC, through its subsidiaries, engages in the acquisition and development of oil and natural gas properties in the United States. Its properties are located in the southern portion of the Appalachian Basin, primarily in southeast Kentucky and northeast Tennessee; the Permian Basin, primarily in west Texas and southeastern New Mexico; and south Texas. As of December 31, 2010, the company had estimated proved reserves of 69.3 million barrels of oil equivalent, as well as working interests in 2,270 net productive wells. Vanguard Natural Resources, LLC was founded in 2006 and is based in Houston, Texas.

Advisors' Opinion: - [By Matt DiLallo]

One company to watch here is�Vanguard Natural Resources (NASDAQ: VNR ) , which has eschewed increased organic production growth spending until now. However, the company is looking into the possibility of following LINN's blueprint and potentially change its game plan. Last year Vanguard was one of the most conservative E&P MLPs as its adjusted EBITDA was 4.6 times its capital spending. It's one company that certainly has the capacity to pursue organic production growth spending if it can change the philosophical mind-set that would be required to switch models.

- [By Matt DiLallo]

Last year Vanguard Natural Resources (NASDAQ: VNR ) changed its distribution policy and in so doing changed the game for oil and gas producing MLPs. The new monthly distribution policy enabled the company's income-seeking investors to better match their monthly cash outflows with monthly inflows from Vanguard. It was such a unique strategy that the company even trademarked the tag line that the company is "The Monthly Distribution MLP."

5 Best Long Term Stocks To Watch For 2014: Webjet Ltd(WEB.AX)

Webjet Limited, through its subsidiaries, operates as an electronic manager, marketer, and credit card merchant of travel and related services utilizing the Internet and other mediums. It offers airline tickets and travel packages to customers in Australia, New Zealand, Asia, the United States, and Europe. The company is based in Melbourne, Australia.

5 Best Long Term Stocks To Watch For 2014: Murgor Resources Inc (MGR.V)

Murgor Resources Inc. engages in the acquisition, exploration, and development of mineral properties in Canada. The company explores for gold, copper, zinc, and silver deposits. It primarily focuses on exploring the Golden Arrow gold property that consists of 20 patented mining claims and 11 mining claims covering an area of 1,377 hectares in Hislop, McCann, and Playfair townships that are located to the east of the town of Timmins in Ontario. The company was formerly known as Advance Murgor Exploration Limited and changed its name to Murgor Resources Inc. in 1985. Murgor Resources Inc. was founded in 1969 and is headquartered in Kingston, Canada.

5 Best Long Term Stocks To Watch For 2014: Asta Funding Inc.(ASFI)

Asta Funding, Inc., together with its subsidiaries, engages in purchasing, managing, and servicing distressed consumer receivables in the United States. Its principal portfolio includes charged-off receivables consisting of accounts that have been written-off by the originators and might have been previously serviced by collection agencies; semi-performing receivables, including accounts where the debtor is currently making partial or irregular monthly payments, but the accounts might have been written-off by the originators; performing receivables comprising accounts where the debtor is making regular monthly payments that might or might not have been delinquent in the past; and distressed consumer receivables, such as the unpaid debts of individuals to banks, finance companies, and other credit and service providers. The company?s distressed consumer receivables consist of MasterCard, Visa, and other credit card accounts, which were charged-off by the issuers or provide rs for non-payment. Asta Funding, Inc. was founded in 1994 and is based in Englewood Cliffs, New Jersey.

Advisors' Opinion: - [By John Udovich]

Small cap debt collection stocks like�Asta Funding, Inc (NASDAQ: ASFI), Encore Capital Group, Inc (NASDAQ: ECPG) and Portfolio Recovery Associates, Inc (NASDAQ: PRAA) could be the latest target of a government shakedown or crackdown as the Consumer Financial Protection Bureau said this week that�before it formally proposes any rules for debt collection, it wants to hear how collectors verify borrowers' information and communicate with consumers. In other words, debt collectors could be restricted from using text messages, social media or other Internet-based tools in their pursuit to collect debts. With about one in 10 Americans coming out of the financial crisis with some debt in collection, investing in small cap�debt collection stocks has been profitable for investors. However, there is no timeline for when any new rules might be released for review or come into effect.

- [By Tim Melvin]

There a lot of moving parts to Asta Funding (ASFI), but there appears to be a great deal of value that isn�� reflected in the current stock price. ASFI stock is trading at less than 65% of book value, but several of its debt collection assets are carried at zero cost basis and yet may have substantial value. The balance sheet is strong with more than $90 million in cash. ASFI has been moving into other businesses including disability claims to increase its growth opportunities over the next few years. It�� a fairly complex business, but it is very cheap — and the first sign of good news could send the shares a lot higher.

5 Best Long Term Stocks To Watch For 2014: Inc (HEO.V)

H2O Innovation Inc. provides integrated technological water treatment solutions based on membrane filtration technology. The company designs, manufactures, and assembles custom-built water treatment systems for the production of drinking water and industrial process water, the reclamation and reuse of water, and the treatment of wastewater. Its products include pressure filters, ultrafiltration systems, NF and RO membranes, mobile and pilot units, Bio-Wheel biological treatment systems, Bio-Brane membrane bioreactors, and BiH2Omobile mobile wastewater treatment systems. The company is also involved in the design and production of seawater desalination systems, as well as provision of turnkey solutions. In addition, it provides membrane pretreatment chemicals, membrane cleaners, membrane preservatives, and coagulants and flocculants for maintaining and operating municipal, industrial, and commercial reverse omission systems. H2O Innovation Inc. serves municipalities and com munities; mining, oil, and energy; pharmaceutical, hospital, and research; commercial and agrifood; and industrial and manufacturing sectors, as well as maple syrup industries in Canada, the United States, Tunisia, China, Egypt, and internationally. The company was formerly known as H2O Innovation (2000) Inc. and changed its name H2O Innovation Inc. in December 2008. H2O Innovation Inc. was founded in 2000 and is headquartered in Quebec, Canada.

5 Best Long Term Stocks To Watch For 2014: Caspian Oil & Gas Ltd (CIG.AX)

Equus Mining Limited focuses on the identification, evaluation, and development of copper and gold resource properties in Chile. The company has an option to acquire 100% interests in the group of 14 Mining Licenses covering an area of 18.05 square kilometers and is located in the Naltagua Copper District, southeast of San Antonio city. It also has interests in the Yerba Project in the Naltagua Copper system; and the Araya Project in the south-central portion of the Naltagua Copper System. The company was formerly known as Caspian Oil & Gas Limited and changed its name to Equus Mining Limited in November 2012. Equus Mining Limited is headquartered in Sydney, Australia.

5 Best Long Term Stocks To Watch For 2014: Cree Inc.(CREE)

Cree, Inc. develops and manufactures light emitting diodes (LEDs), LED lighting, and semiconductor solutions for wireless and power applications. Its LED products include blue and green LED chips that are used in various applications, including video screens, gaming displays, function indicator lights, and automotive backlighting; LED components comprising a range of packaged LED products and LED modules for lighting applications; LED lighting products, such as LED downlights, LED troffers, and LED lamps or bulbs for construction, retrofit, and renovation projects in commercial, governmental, and residential applications; and silicon carbide (SiC) wafers, which are used in the manufacture of optoelectronics, microwave, power switching, and other applications. The company also provides semiconductor materials and devices primarily based on silicon carbide (SiC), gallium nitride (GaN), and related compounds. Its power and radio frequency (RF) products include SiC-based power products comprising 600, 1,200, and 1,700-volt Schottky diodes, as well as 1,200-volt SiC metal semiconductor field-effect transistor switches that are used in power factor correction circuits for power supplies in computer servers and other applications, such as solar inverters; and RF devices, including a range of GaN high electron mobility transistors and monolithic microwave integrated circuits for military or commercial applications, as well as 10 watt and 60 watt SiC transistors and metal semiconductor field effect transistor products. The company primarily operates in China, the United States, Europe, South Korea, Japan, Malaysia, and Taiwan. Cree, Inc. was formerly known as Cree Research, Inc. and changed its name in January 2000. Cree, Inc. was founded in 1987 and is based in Durham, North Carolina.

Advisors' Opinion: - [By Wallace Witkowski]

Shares of Cree Inc. (CREE) �fell 15% to $63.10 in heavy volume after the LED-light maker forecast a fiscal fourth-quarter earnings outlook that fell below the Wall Street consensus. Cree sees adjusted fourth-quarter earnings of 36 cents to 41 cents a share, while the consensus is 44 cents a share.

- [By Paul Ausick]

Cree Inc. (NASDAQ: CREE) stock was upgraded to Buy that same morning by analysts at Canaccord Genuity and the firm put a new price target of $80 on the Cree�� shares. The company had recently introduced a new generation of LED light that it said is 78% smaller than a previous design yet packs the same performance punch.

- [By Monica Gerson]

Cree (NASDAQ: CREE) issued a downbeat earnings forecast for the fiscal fourth quarter. Cree shares tumbled 15.23% to $63.00 in the after-hours trading session.

- [By Lauren Pollock]

Cree Inc.(CREE) said its fiscal second-quarter earnings rose 75% on broad sales growth for the maker of LED lighting products and semiconductor components. Shares edged up 2.5% to $64.39 premarket.

5 Best Long Term Stocks To Watch For 2014: Rada Electronics Industries Limited(RADA)

Rada Electronic Industries Ltd. engages in the development, manufacture, and sale of defense electronics to government agencies and authorities, government-owned companies, and integrators in Israel, Asia, North America, South America, Latin America, and Europe. Its products include data/video recording and management systems, such as mission data and digital video recorders, airborne data servers, post-mission debriefing solutions, and head-up display video cameras for aerial and land platforms; inertial navigation systems for aerial and land platforms; avionics solutions, including avionics for unmanned aerial vehicles; and radar sensors for anti-terrorism/force protection systems. The company also sells and supports legacy commercial aviation test stations, as well as offers test and repair services. It has strategic relationships with Lockheed Martin Aeronautics, GE Aviation, Israel Military Industries, Israel Aerospace Industries, Hindustan Aeronautics Ltd., and Embra er and Rafael Advanced Defense Systems Ltd. Rada Electronic Industries Ltd. was founded in 1970 and is based in Netanya, Israel.

5 Best Long Term Stocks To Watch For 2014: Essex Property Trust Inc. (ESS)

Essex Property Trust, Inc. operates as a self-administered and self-managed real estate investment trust in the United States. It engages in the ownership, operation, management, acquisition, development, and redevelopment of apartment communities, as well as commercial properties. As of March 31, 2012, the company owned or had interests in 158 apartment communities; and 5 commercial buildings, as well as 5 development projects. Its communities are located in Los Angeles, Orange, Riverside, San Diego, Santa Barbara, and Ventura counties in southern California; and the San Francisco Bay area in northern California, as well as in the Seattle metropolitan area. The company has elected to be taxed as a real estate investment trust. As a result, it would not be subject to corporate income tax on that portion of its net income that is distributed to shareholders. Essex Property Trust, Inc. was founded in 1971 and is headquartered in Palo Alto, California.

Advisors' Opinion: - [By Jayson Derrick]

Bloomberg reported�Essex Property Trust Inc. (NYSE: ESS) has made an offer to acquire BRE Properties for about $5 billion.

BRE Properties Chief Executive Office Constance B. Moore had publicly hinted earlier this year that the company would consider ��ny legitimate proposal��after an investment firm Land & Buildings had made a $4.6 billion offer valued at $60 a share.

- [By Sean Williams]

To get a better idea of how RealPage is doing, it's always best to look at occupancy rates for some of the nation's biggest residential-REITs. In AvalonBay Communities' (NYSE: AVB ) most recent quarter, the company reported a 5% increase in revenue attributable to a 4.7% boost in prices in established communities, and a 0.3% uptick in occupancy. For Equity Residential (NYSE: EQR ) it was much of the same, with revenue rising 5.4% in the fourth-quarter as occupancy rates rose 40 basis points to 95.4% from the year-ago period. Finally, Essex Property Trust (NYSE: ESS ) delivered some of the strongest occupancy results of all, with 96.9% of its units occupied as of the end of January. The point is that with occupancy rates at their lowest levels in more than a decade, these residential REITs are driving growth by boosting prices because of rent scarcity.

5 Best Long Term Stocks To Watch For 2014: DARA Biosciences Inc.(DARA)

DARA BioSciences, Inc., a development stage biopharmaceutical company, engages in the development and commercialization of oncology treatment and supportive care pharmaceutical products in the United Sates. Its products include Soltamox for the treatment of breast cancer; Gemcitabine for first-line therapy for ovarian, breast, lung and pancreatic cancers; and other cancer support therapeutics, as well as generic sterile injectable cytotoxic products. Its drug development programs include KRN5500, a non-narcotic/non-opioid that has completed Phase IIa clinical trial for the treatment of neuropathic pain in cancer patients; and DB959, which has completed a Phase I study for the treatment of metabolic diseases, including type 2 diabetes and dyslipidemia. The company?s pre-clinical drug candidate includes DB900 PPAR gamma/alpha/delta agonists for development in metabolic and inflammatory diseases; DB160, DPPIV enzyme inhibitors with applications in diabetes, stem cell transpl antation, and cancer therapy; and DB200, Carnitine palmitoyltransferase-1 for skin diseases, including psoriasis. DARA BioSciences, Inc. was incorporated in 2002 and is headquartered in Raleigh, North Carolina.

Advisors' Opinion: - [By Bryan Murphy]

Without knowing the whole story, it would be easy to dismiss the big 9% jump from DARA Biosciences Inc. (NASDAQ:DARA) today as nothing more than a little volatility.... bullishness that wasn't destined to linger, especially considering how ugly the market turned in Monday's trading. As is always the case, though, with DARA, there's more to the story. Today's move may well be the official beginning of a much bigger, trade-worthy rally.

5 Best Long Term Stocks To Watch For 2014: Solar Capital Ltd.(SLRC)

Solar Capital Ltd. is a business development company specializing in investments in leveraged companies, including middle market companies. The firm invests in aerospace and defense; automotive; beverage, food and tobacco; broadcasting and entertainment; business services; cable television; cargo transport; chemicals, plastics and rubber; consumer finance; consumer services; containers, packaging and glass; direct marketing; distribution; diversified/conglomerate manufacturing; diversified/conglomerate services; education; electronics; energy, utilities; equipment rental; farming and agriculture; finance; healthcare, education and childcare; home and office furnishing, consumer products; hotels, motels, inns and gaming; industrial; infrastructure; insurance; leisure, motion pictures and entertainment; logistics; machinery; media; mining, steel and non precious metals; oil and gas; personal, food and miscellaneous services; printing, publishing and broadcasting; real estate ; retail stores; specialty finance; technology; telecommunications; and utilities. It invests in the form of senior secured loans, mezzanine loans, and equity securities. It also invests in equity securities, such as preferred stock, common stock, warrants and other equity interests received in connection with its debt investments or through direct investments. The firm also invests in United States government securities, high-quality debt investments that mature in one year or less, high-yield bonds, distressed debt, non-United States investments, or securities of public companies that are not thinly traded. Solar Capital Ltd. was founded in November 2007 and is based in New York, New York.

AFP/Getty Images

AFP/Getty Images  Stock Bulls: You want the 49ers in the Super Bowl

Stock Bulls: You want the 49ers in the Super Bowl

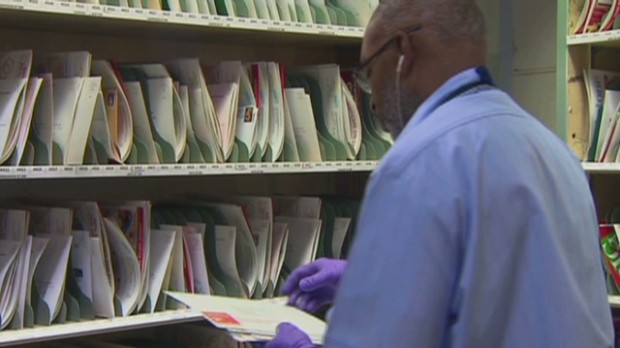

No Saturday mail? USPS chief responds

No Saturday mail? USPS chief responds  Related BZSUM Benzinga Weekly Preview: Investors Get A Break As Earnings Slow Market Wrap For February 14: Markets End The Week Positive

Related BZSUM Benzinga Weekly Preview: Investors Get A Break As Earnings Slow Market Wrap For February 14: Markets End The Week Positive

Who hacked Target?

Who hacked Target?