The performance of the restaurant industry is generally perceived to have close ties with the overall activity in the economy. Therefore, the recovery in the US economy indicated by the recent statistics regarding consumer confidence is likely to be reflected in the stock prices of restaurant companies as well. At the same time, the food business is essentially perceived to be robust compared to economic and financial shocks because of the inelastic nature of the demand for its products. McDonald's Corporation (MCD) is one of the largest players in the international restaurant business with the market capitalization of $99.3 billion and annual revenues of $27.6 billion in FY12. Over the years, the company has been able to strengthen its balance sheet substantially while supporting its growth prospects and earning the trust of its investors. The company's balance approach towards growth, financial stability and investor considerations is exemplary for any mature business entity.

Stock Performance

Since the beginning of the current year, the stock price of the company has appreciated from $88 to a current price of $98. This stock price appreciation has been supported substantially by the overall bullish trend in the market and the economic policy pursued by the Federal Reserve to stimulate recovery.

(click to enlarge)

Source: YCharts

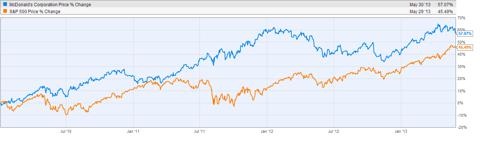

The above chart shows the stock price of the company as compared to the S&P 500 index since the beginning of FY10. We see that in this period, the whole market has shown a strong bullish trend. Secondly, the company has outperformed the market index by posting a stock price appreciation of 57.1% whereas the index has appreciated by 45.5%. Therefore, we may infer that apart from the support from the overall economic conditions, the company's financial performance and growth prospects have also been recognized by the market. Furthermore! , with such companies, an additional aspect of quality of earnings is also introduced. The company has been paying considerable dividends in support of its earnings over the years which are important for long term investors.

Performance and Growth

The financial performance of the company over the past few years has also reflected the strength of the company's business model as the company has managed to continue its growth despite the difficult circumstances. This has been done by pursuing a regionally well diversified portfolio which limits the company's risks associated with one region, which in the past few years has been linked with the European economic conditions.

(click to enlarge)

Source: YCharts

The above chart shows the net income and dividends of McDonald's since the beginning of FY10. The chart shows a smooth upward trend throughout the period. The net income has shown some stagnation towards the first quarter of FY13 but investors believe this to be temporary as reflected in the company's stock price.

(click to enlarge)

Data Source: YCharts

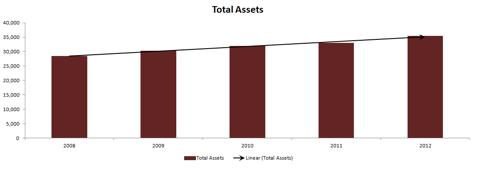

The above chart shows the company's total assets over the last five years. The chart evidently shows that the company's total assets have posted a sizable growth over this reference period as indicated by the trend line. The assets of the company have demonstrated a CAGR of 5.6% which is a decent figure for a mature company.

Financial Stability

For a long term investment, investors very closely consider the company's financial stability and strength to cope with adverse circumstances. In this perspective, McDonald's has done a very decent job in achieving investor's trust by increasingly strengthening the balance sheet and showing impeccable resistance in times of crisis.

(click to enlarge)

Data Source: Morningstar

The above charts show the financial risk indicators for McDonald's over the past four years. The first portion of the chart focuses on the company's liquidity and we see that for the past four years, the company has further improved its liquidity position. The second part of the chart shows financial leverage and debt proportion of the company's capital structure over the same reference period. We see that this risk has shown an increasing trend but the figures are far from raising a red signal as the debt levels are at manageable proportions.

(click to enlarge)

Source: YCharts

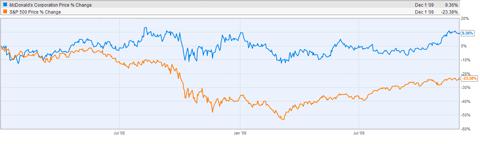

The above chart shows the most important section of the analysis as its shows the stock price of the company and the S&P 500 index since the beginning of FY08 to the end of FY09. This chart shows the period of financial meltdown and as reflected by the index line, the economy underwent a severe decline. The strength of the company's business is reassured by the chart as during this period, the stock price of the company showed an appreciation of 9.4% against a decrease of 23.4% of the S&P 500 index.

Comparative Valuation

Data Source: Morningstar

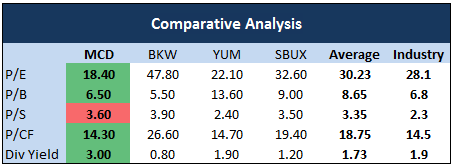

The above chart shows some key valuation metrics of McDonald's as compared to some of its competitors which include Burger King Worldwide (BKW), Yum Brands (YUM) and Starbucks Corp. (SBUX). The table also shows the industry average. We see that across most of the valuation multiples, the company is undervalued and the stock price still has considerable upside potential. At the same time, the company is offering a dividend yield which remains unmatched across the company's major competitors and the overall industry.

Conclusion

The g! raphical representation clearly shows that the stock price has shown remarkable appreciation over the past years but the strength of the business, its growth prospects and financial stability indicate that the bullish trend is not over yet. Furthermore, the undervaluation provides a major upside along with the high dividend yield which will further attract long term investors. Keeping these factors in consideration, I propose a buy recommendation on McDonald's for long term investors.

Disclosure: I have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article. (More...)

No comments:

Post a Comment