For a consumption based economy to grow, the median family spending money must continue to grow. The disposable income headlines misleadingly infer income is growing.

There are facts, and then there are facts. The headline numbers from the U.S. Census, Bureau of Labor Statistics and Bureau of Economic Analysis are either gross numbers for the entire economy or the gross number divided by the population (per capita). When you view this headline data, either you believe the average person is doing better - or you feel the government is lying because you and everyone around you are worse off.

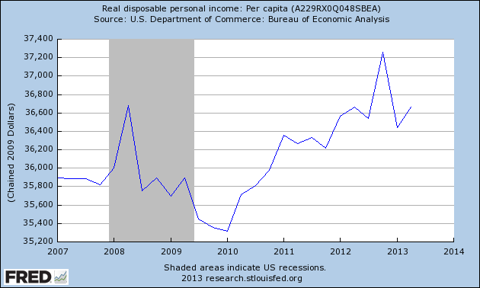

Chart 1 - Per Capita Real Disposable Income(click to enlarge)

In a consumption based economy, the amount of money in the hands of the consumer is the economic driver. If consumers are flooded with money, often they will buy the best car. If the consumers are poor, they will buy the cheapest car and only when necessary.

Top 5 Heal Care Companies To Buy Right Now

As background to what I am arguing, Econintersect published a Sentier Research summary study which showed Household Income Down by 4.4% Overall Post Recession. This post is based on supplemental data provided to Econintersect from Sentier Research LLC.

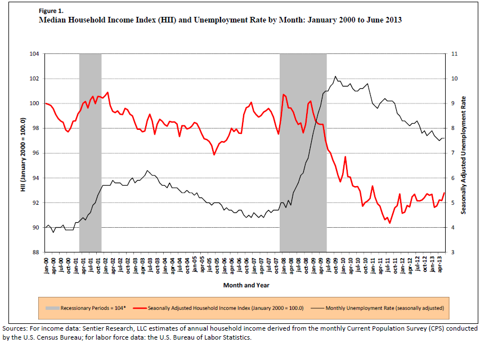

Here is where median income is important as we are looking at the income of the 50th percentile consumer. Watching the income of the 50th percentile tells you about the affordability of refrigerators to the 50th percentile consumer. Figure 1 below shows median income (red line, Figure 1) is declining while headline per capita (Chart 1 above) increases.

(click to enlarge)

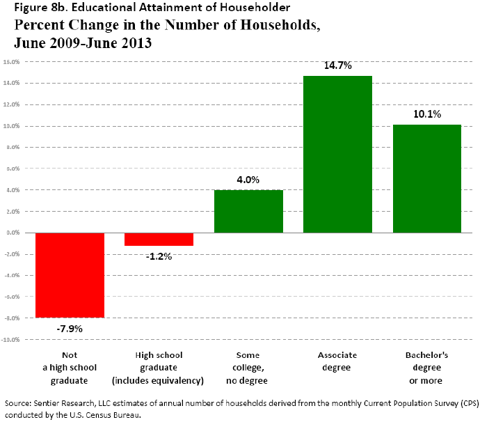

One of the larger surprises in the data related to factors based on education. Growth in number of hou! seholds varied with education; households with some college increased, while households with no college decreased.

(click to enlarge)

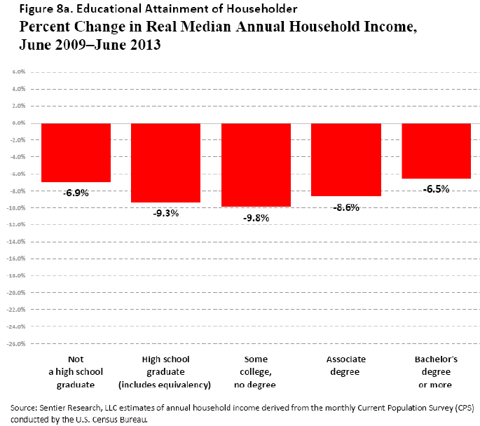

Yet, earnings in all educational groups declined. Below are the current median incomes:

not a high school graduate = $24,448.high school graduate (including equivalency) = $39,282.some college but no degree = $46,572.Associate degree = $56,390.Bachelor's degree or more=$84,705.(click to enlarge)

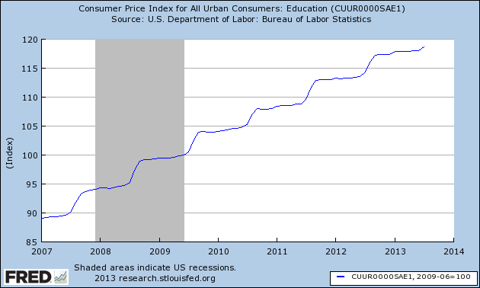

Now consider that the cost of education has increased well over 15% since the end of the Great Recession, and also a recent graduate makes less than the median.

Chart 2 - Change in Cost of Education Since the End of the Great Recession(click to enlarge)

The average cost of a 4 year university (tuition, room and board) is over $21,000. I do not believe a university degree is a good investment for many. However, there are opposing views:

One common recommendation is that citizens should invest more in their education. Spurred by growing demand for workers performing abstract job tasks, the payoff for college and professional degrees has soared; despite its formidable price tag, higher education has perhaps never been a better investment.

In any event, one needs to be concerned with the decay of median income. The data points to the 1% distorting the per capita data and headlines while everyone else is losing ground.

In my instablog, I provide a "forest view" of Friday's Personal Consumption Expenditure and Disposable Income - as well as a review of the economic releases this past week.

Disclosure: I have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this article. (More...)

No comments:

Post a Comment