The hottest ETFs have taken the biggest hit over the past five trading days. Global X Social Media (SOCL), Market Vectors Biotech (BBH) and iShares Russell 2000 Small Cap Growth (IWO) have shed 7.0%, 6.5% and 4.0% respectively. Most attribute the over-sized losses to generalized anxiety over the debt ceiling showdown between Congress and the White House. On the other hand, the highest percentage gainers of 2013 may be dropping more precipitously for a different reason.

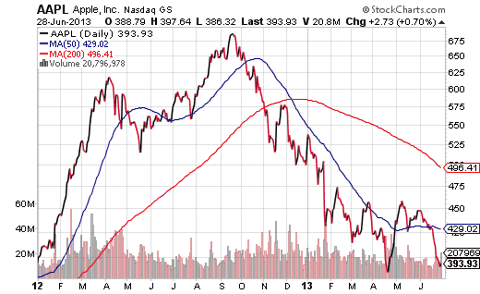

Consider a case study where one might say, “the bigger they climb, the harder they fall.” Shares of Apple (AAPL) proved to be unstoppable in the first nine months of 2012. In fact, you could not find a naysayer on the shares anywhere, as AAPL catapulted from $375 to $700 for 87% unrealized gains. What’s more, nearly every commentator from Jim Cramer to high profile analysts at Goldman Sachs believed $1000 per share had been pre-ordained.

In the next nine months, however, the selling pressure on the previously invincible corporation proved overwhelming. Some blamed deteriorating fundamentals for the nearly 50% haircut from $700 back to $375 per share. Others talked about the rise of other smart phone giants; still others discussed Apple’s waning innovation and/or leadership. In all likelihood, though, profit-taking on the remarkable capital appreciator simply morphed into a runaway boulder — a boulder that could not be stopped until it reached the bottom of the mountain.

(click to enlarge)

I am not suggesting that biotech, or “dot-com 2.0″ or small-cap growth stocks are setting up for epic fall from grace. I am suggesting, however, that the debt limit stand-off is giving an excuse for investors to sell their winners. What’s more, that snowball has the potential to gain speed, even when political leaders reach an inevitable arrangement.

Best Penny Companies To Own For 2014

How will we know? Assuming the government gets its act together (enough so that there are no more cliffs/crises/showdowns in 2013), pay extra close attention to the best performing sectors. If they are the same groups (e.g., biotech, “new tech,” small-cap growth, etc.,), you’ll know that the investment community returned to momentum-based performance chasing. In contrast, if the hottest areas struggle in spite of a debt agreement, a rotation into “risk-sort-of-on” assets might be transpiring.

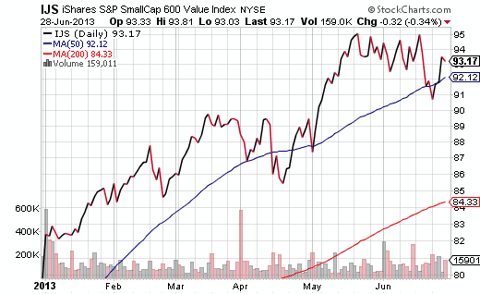

On behalf of most of my clients in 2013, I chose to overweight tech and health care. However, I did so with areas that are traditionally less volatile. I continue to own Powershares Pharmaceuticals (PJP) and/or SPDR Select Healthcare (XLV). I’ve been a proponent of “old tech” with the attractive prices and dividends; First Trust NASDAQ Tech Dividend (TDIV) fits the bill. Additionally, I have remained faithful to iShares Small Cap Value (IJS) for small-cap exposure, rather than hop on the IWO express.

(click to enlarge)

Keep in mind, if political gamesmanship leads to something entirely bearish, I will reduce some of the portfolio risk. My use of mechanical, unemotional stops and trendlines might reduce exposure to funds like PJP, IJS and TDIV. Nevertheless, there’s little reason to put the cart before the horse here. The more probable scenario is that current price depreciation will offer up a final buying opportunity in the existing calendar year.

Disclosure: Gary Gordon, MS, CFP is the president of Pacific Park Financial, Inc., a Registered Investment Adviser with the SEC. Gary Gordon, Pacific Park Financial, Inc, and/or its clients may hold positions in the ETFs, mutual funds, and/or any investment as! set menti! oned above. The commentary does not constitute individualized investment advice. The opinions offered herein are not personalized recommendations to buy, sell or hold securities. At times, issuers of exchange-traded products compensate Pacific Park Financial, Inc. or its subsidiaries for advertising at the ETF Expert web site. ETF Expert content is created independently of any advertising relationships.

Source: What Can Apple Teach ETF Investors About Performance Chasing?

No comments:

Post a Comment