BALTIMORE (Stockpickr) -- Put down the 10-K filings and the stock screeners. It's time to take a break from the traditional methods of generating investment ideas. Instead, let the crowd do it for you.

>>5 Mega-Cap Stocks to Trade for Gains

From hedge funds to individual investors, scores of market participants are turning to social media to figure out which stocks are worth watching. It's a concept that's known as "crowdsourcing," and it uses the masses to identify emerging trends in the market.

Crowdsourcing has long been a popular tool for the advertising industry, but it also makes a lot of sense as an investment tool. After all, the market is completely driven by the supply and demand, so it can be valuable to see what names are trending among the crowd.

While some fund managers are already trying to leverage social media resources like Twitter to find algorithmic trading opportunities, for most investors, crowdsourcing works best as a starting point for investors who want a starting point in their analysis. Today, we'll leverage the power of the crowd to take a look at some of the most active stocks on the market today.

>>5 Stocks Under $10 Set to Soar

These "most active" names are the most heavily-traded names on the market -- and often, uber-active names have some sort of a technical or fundamental catalyst driving investors' attention on shares. And when there's a big catalyst, there's often a trading opportunity.

Without further ado, here's a look at today's stocks.

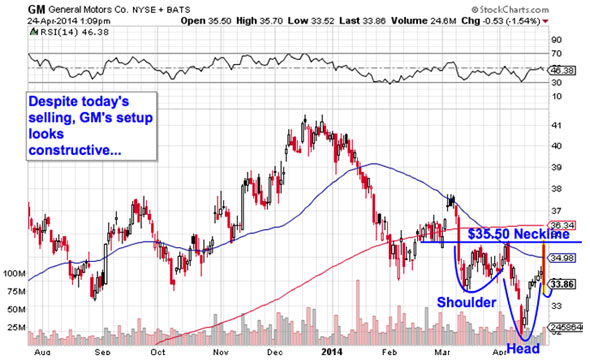

General Motors

Nearest Resistance: $35.50

Nearest Support: $32

Catalyst: Q1 Earnings

Despite some big black clouds over its first-quarter earnings call, General Motors (GM) beat analysts' expectations by 2 cents, taking home 6 cents per share in profit. Recalls hammered earnings, with a $1.3 billion one-time charge for recall repairs on the books. But while things were "less bad" than expected, investors are pushing shares lower on big volume this afternoon.

Looking longer-term, GM's chart could actually look a lot worse. This stock is looking "bottomy" after spending all of 2014 selling off to the tune of 14%. A breakout above $35.50 is the signal that it's time to be a buyer in GM.

ServiceNow

Nearest Resistance: $55

Nearest Support: $49

Catalyst: Q1 Earnings

$7 billion cloud-based IT service firm ServiceNow (NOW) is down 6% on big volume this afternoon, following a wider-than-expected loss for the first quarter. NOW lost 30 cents per share in the first three months of 2014, while investors were only expecting a consensus loss of 8 cents. The fundamental miss isn't a game-changer for this stock, but the technical miss paints a different picture.

NOW looks "toppy" in the longer-term. Shares have been forming a head and shoulders top since the start of October, a bearish setup that triggers on a move through support at $49. The setup in NOW is a long-term pattern, and that means that it comes with equally long-term trading implications on a breakdown below that $49 level. Shares flirted with a breakdown this morning before recovering later in the day. Keep a close eye on NOW's ability to catch a bid this week.

Verizon

Nearest Resistance: $48

Nearest Support: $44.50

Catalyst: Q1 Earnings, Technical Setup

Verizon Communications (VZ) is seeing some earnings-induced selling of its own this afternoon. Verizon posted its first-quarter numbers this morning, earning 84 cents for the last three months. That number fell 3 cents short of the 87 cent profit that analysts were expecting, but the real story is in subscriber count -- VZ lost wireless customers for the first time in its history last quarter, a byproduct of a hugely competitive market that's quickly becoming commoditized.

From a technical standpoint, the 2.7% drop on high volume today shouldn't come as a big surprise. After all, VZ has been bouncing lower in a well-defined trend channel since last November. With shares touching the top of the range back on Monday, a move lower was the high-probability outcome unless VZ really impressed investors. Look for shares to settle closer to $44.50 from here.

To see these stocks in action, check out the at Most-Active Stocks portfolio on Stockpickr.

-- Written by Jonas Elmerraji in Baltimore.

RELATED LINKS:

>>QE5 Is Coming -- Here's What It Means to Your Portfolio

>>5 Stocks With Big Insider Buying

>>3 Big-Volume Stocks to Trade for Breakouts

Follow Stockpickr on Twitter and become a fan on Facebook.

At the time of publication, author was long AAPL.

Jonas Elmerraji, CMT, is a senior market analyst at Agora Financial in Baltimore and a contributor to

TheStreet. Before that, he managed a portfolio of stocks for an investment advisory returned 15% in 2008. He has been featured in Forbes , Investor's Business Daily, and on CNBC.com. Jonas holds a degree in financial economics from UMBC and the Chartered Market Technician designation.Follow Jonas on Twitter @JonasElmerraji

No comments:

Post a Comment